Why Hard-to-Place Merchants Credit Card Processing Matters Now More Than Ever

Imagine building a business with tenacity—only to find that accepting credit card payments is where your growth grinds to a halt. For countless companies operating in high-risk or unconventional industries, “hard-to-place” merchant status can turn essential payment processing into a major roadblock. In today’s digital economy, where 80% of consumers say they prefer card or electronic payments, being unable to accept credit cards not only limits revenue but also damages reputation and trust. If your business has faced repeated rejections or slowdowns when seeking merchant services, the impact is more than transactional—it’s existential.

Hard-to-place merchants credit card processing refers to securing solutions for businesses that traditional payment providers consider risky or complex. This challenge spans industries like multilevel marketing, wellness, subscription services, and beyond. Those who don’t address it quickly risk losing competitive ground. Understanding why these hurdles exist, how to overcome them, and discovering actionable approval tips isn’t just a tangential concern—it’s fundamental for ongoing business viability. If your brand is battling complexity, unpredictability, or regulatory scrutiny when it comes to payment acceptance, unlocking tailored merchant processing is crucial to create longevity.

Understanding the Landscape: What Makes Credit Card Processing Complex for Hard-to-Place Merchants?

At its core, hard-to-place merchants credit card processing involves working with businesses that don’t fit neatly into traditional payment provider checklists. These merchants might operate in industries flagged as high-risk—such as supplements, e-commerce, recurring billing, or even innovative online services. Payment solutions like credit and debit card transaction processing, POS integration, and even digital wallet acceptance are standard for most retailers, but for these niche industries, securing reliable merchant services is far from straightforward. Each transaction could be met with heightened scrutiny, frequent account reviews, or even sudden service interruptions from mainstream providers.

The stakes for getting this right are significant. Without effective merchant accounts and advanced fraud prevention, businesses face not only sales barriers but also increased vulnerability to chargebacks, compliance failures, or even involuntary account closures. Unfortunately, a misunderstanding of the landscape—or relying on generic solutions—can backfire and compound existing financial difficulties. By mastering the specifics of how merchant services work for hard-to-place industries, forward-thinking business owners can sidestep pitfalls, reduce processing fees, and enable digital transformation that supports seamless, secure customer payment experiences.

How Specialized Merchant Services Empower High-Risk and Hard-to-Place Businesses

Entering the world of hard-to-place merchants credit card processing is about far more than technical setup—it’s a strategic business decision that can open doors to growth, efficiency, and stronger fraud prevention. AVP Solutions (American Verification Processing Solutions) leverages Tiffany's over 35 years of industry experience to design customizable payment solutions for businesses that others overlook. The commitment to secure, fast transactions and tailored pricing allows companies in high-risk sectors to manage electronic payments both in-person and online, with peace of mind that compliance and innovation are prioritized.

The benefits ripple across every facet of daily business. First, fast approval and dedicated 24/7 support ensure operational continuity—even if transaction volumes spike or payment disputes arise. Second, comprehensive fraud-reduction strategies and chargeback protection remove much of the uncertainty that drives up costs for hard-to-place merchants. Finally, solutions like integrated POS, virtual terminals, and robust online payment gateways empower companies to offer multiple payment options, creating a frictionless customer experience that boosts loyalty and sales. With these tools, high-risk or unconventional businesses transform payment processing from a vulnerability into a powerful competitive advantage.

What is Considered a High-Risk Merchant, and Why Does It Matter?

The term “high-risk merchant” is pivotal in understanding why some businesses struggle to obtain credit card processing solutions. A merchant might fall into this category due to industry reputation, regulatory rules, sales models (like subscriptions or international sales), or even past chargeback history. This distinction affects everything from approval speed to transaction fees and even ongoing account monitoring. Mainstream banks and payment processors often decline these applicants outright, citing larger-than-average exposure to fraud or financial instability.

Yet, being labeled high-risk isn’t a permanent barrier—it’s a catalyst for seeking out tailored merchant services primed for flexibility, compliance, and adaptability. AVPS, for example, delves into the specific challenges of these sectors, offering clear, actionable advice to reduce costs, navigate the onboarding process, and maintain uninterrupted payment acceptance. By understanding the difference between standard and high-risk merchant accounts, business owners can better advocate for solutions that address their unique situation and keep revenue channels open, even under regulatory changes and market shifts.

Innovative Payment Solutions: From Virtual Processing to Integrated POS

Modern hard-to-place merchants aren’t limited to a single service. Evolving payment processing technology delivers a suite of options—from secure credit and debit card acceptance to advanced virtual terminals and integrated POS systems. Features like contactless processing, online recurring payments, and support for digital wallets enable businesses to meet customers wherever they choose to transact. This multifaceted approach is not just a convenience—it’s a necessity in a world where payment preferences are rapidly evolving.

With the addition of robust fraud prevention and recurring payment tools, businesses can also reduce their chargeback risk and protect against financial losses. High-risk merchant services that factor in advanced security technology help level the playing field, allowing companies of all sizes to accept payments securely while minimizing exposure to unforeseen disputes. This layered approach underpins long-term sustainability and positions hard-to-place merchants as credible, future-ready business partners.

Practical Steps for Quick Approval: Tips for Navigating the Hard-to-Place Merchant Process

Success in securing hard-to-place merchants credit card processing often hinges on preparation and transparency. First, gather comprehensive documentation—this includes business licenses, bank statements, a clear description of goods or services, and operational policies. Thorough records support your legitimacy and reassure providers about your risk profile. Second, proactively address potential red flags such as past chargeback volumes or industry-specific regulatory requirements. Clear policies for handling disputes, along with active fraud prevention, show a commitment to compliance.

Lastly, select a provider that goes beyond cookie-cutter solutions. High-value partners like AVPS offer hands-on support and adapt quickly as business needs change, smoothing out the approval process with human expertise and agile support teams. By following these guidelines—proper documentation, transparency, and engaging with specialized merchant services—businesses dramatically increase their chances of a quick, trouble-free approval that keeps commerce flowing.

American Verification Processing Solutions: Philosophy and Industry Approach

American Verification Processing Solutions brings a philosophy centered on personalized partnership, innovation, and uncompromising security to the merchant services landscape. With a legacy spanning 35 years, AVPS has developed a nuanced understanding of what hard-to-place merchants truly need: more than just technology, they seek advocates who recognize their challenges, anticipate their questions, and respond swiftly when issues arise. The team’s devotion to 24/7 support underscores this approach—clients are never left navigating complex scenarios alone.

What sets AVPS apart is the integration of custom payment solutions that span in-person, online, and virtual ecosystems. By combining comprehensive fraud prevention and transparent, competitive pricing, AVPS enables high-risk businesses to transform payment processing into a source of stability and growth. The focus is always on empowering businesses to accept payments quickly, securely, and with confidence—whether through advanced POS integration, secure online gateways, or innovative contactless methods.

Real Success Stories: High-Risk Merchants Find Support and Growth

Many business owners in high-risk sectors share initial apprehension about securing reliable merchant accounts. For those who find the right partner, the journey takes a positive turn—unlocking not only consistent revenue, but significant peace of mind. One merchant with years of experience summed up the experience this way:

As a seasoned business owner operating in the high-risk sector of multilevel marketing and anti-aging products, I have had the pleasure of partnering with AVPS for over seven years. During this time, I have consistently been impressed by their exceptional service and unwavering commitment to supporting high-volume merchants like myself, processing over $500 million annually. From the outset, AVPS has proven to be an invaluable partner in navigating the complexities associated with high-risk credit card processing. Their expertise in this niche market has been instrumental in ensuring that my business operates smoothly and efficiently. The professionalism and dedication exhibited by Tiffany and her team have made a significant difference in my experience as a merchant. One of the standout features of AVPS is their proactive approach to handling challenges that inevitably arise in the world of high-risk processing. Whether it's a sudden spike in transaction volume or a need for rapid issue resolution, Tiffany has always been quick to respond, providing clear communication and effective solutions. This level of support has not only alleviated potential stress but has also allowed me to focus on growing my business. In addition to their exceptional customer service, AVPS offers highly competitive pricing that has made a tangible impact on my bottom line. Their transparent fee structure ensures that I can manage my costs effectively while benefiting from their top-notch services. As an agent representing them, I have always appreciated their prompt and reliable payment schedules, which further underscores their professionalism and dedication to their partners. Moreover, AVPS continually invests in technology and resources that enhance the overall processing experience. Their robust platform is user-friendly and equipped with advanced security features, providing peace of mind for both my business and my customers. This commitment to innovation ensures that I stay ahead in a rapidly evolving market. In conclusion, I wholeheartedly recommend AVPS to any high-risk merchant seeking a reliable and knowledgeable credit card processing partner. Their expertise, commitment to customer service, and competitive pricing make them a standout choice in the industry. With their support, I have been able to navigate the complexities of high-risk processing with confidence, knowing that I have a trusted ally by my side. Thank you, Tiffany and the entire team at AVPS, for your outstanding service and partnership over the years!

The validation of these longstanding partnerships highlights how robust, responsive support and transparent pricing can make even the most complex merchant accounts manageable. Others in search of hard-to-place merchants credit card processing solutions should take comfort knowing that success, stability, and peace of mind are attainable with the right preparation and partner.

Looking Ahead: Why Hard-to-Place Merchants Credit Card Processing Is a Business Essential

As commerce continues to digitize and regulatory environments evolve, securing effective hard-to-place merchants credit card processing is no longer an optional upgrade, but an operational necessity. Businesses in high-risk or complex industries cannot afford delays, hidden fees, or compliance missteps. Industry leaders like American Verification Processing Solutions contribute strategic guidance and advanced technology that shifts payment acceptance from a risk to a core strength.

With the right approach and the support of seasoned experts, hard-to-place merchants transform payment hurdles into stepping stones for growth and customer loyalty. Understanding, investing in, and optimizing merchant accounts is ultimately an investment in the business’s future—proving that every firm can unlock quick approvals and robust solutions, no matter how challenging their market.

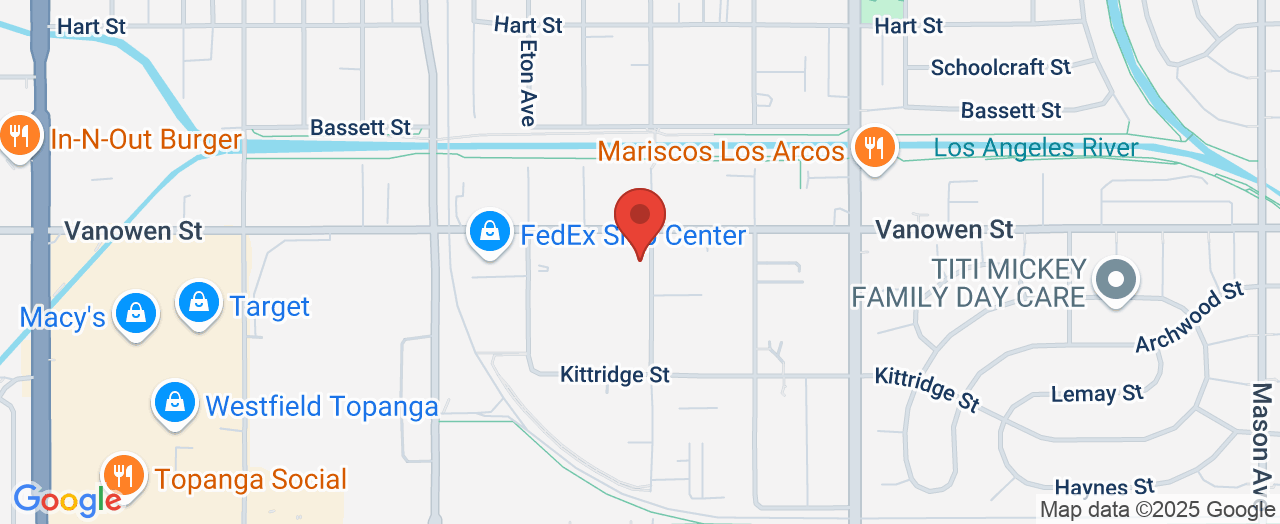

Contact the Experts at American Verification Processing Solutions

If you’d like to learn more about how hard-to-place merchants credit card processing could benefit your business, contact the team at American Verification Processing Solutions. 📍 Address: 6737 Variel Ave, Canoga Park, California 📞 Phone: +1 800-719-9198 🌐 Website: https://avpsolutions.com/

American Verification Processing Solutions Location and Availability

🕒 Hours of Operation:📅 Monday: 7:00 AM – 4:00 PM📅 Tuesday: 7:00 AM – 4:00 PM📅 Wednesday: 7:00 AM – 4:00 PM📅 Thursday: 7:00 AM – 4:00 PM📅 Friday: 7:00 AM – 4:00 PM📅 Saturday: ❌ Closed📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment