Navigating Nevada Trucking Insurance: Safeguard Your Haul, Your Assets, and Your Business Future

Imagine a single accident derailing your trucking operation or a cargo loss threatening the financial stability you’ve built mile after mile. For hundreds of Nevada’s commercial truck owners and operators, misunderstanding insurance requirements can cost far more than monthly premiums—sometimes, it can put businesses at risk of collapse. Trucking in Nevada isn’t just about staying on schedule or maintaining a fleet; it’s about proactively insulating yourself from the kinds of setbacks that have put countless others out of business.

Nevada trucking insurance isn’t just paperwork. It’s the lifeblood safety net for an industry that faces unique regulatory, legal, and operational risks—many unseen by those outside the transportation sector. Yet, too often, misconceptions and cut-rate policies lead to gaps in protection, leaving truck owners exposed at the worst possible moments. Investing in proper coverage is no longer optional; it’s an essential pillar of business resilience and compliance. This article explores where critical mistakes are made, how to spot them, and what you should expect from true Nevada trucking insurance experts.

Understanding Nevada Trucking Insurance: Risks, Requirements, and Relief

At its core, Nevada trucking insurance is a network of coverages designed to protect trucking companies, owner-operators, and private carriers from the range of hazards unique to interstate and intrastate transportation. Coverage needs often span commercial auto liability, cargo protection, motor truck general liability, and add-ons like trailer interchange insurance or long-haul policies. A typical mistake is assuming basic auto insurance suffices—yet that oversight can leave freight companies exposed to devastating lawsuits, cargo losses, and regulatory penalties.

Trucking insurance in Nevada is intertwined with both federal and state requirements, making it vital for businesses to be vigilant about compliance. Missing a policy update, letting a coverage lapse, or failing to carry the correct cargo or fleet insurance can halt operations and trigger costly fines. There’s also a human element—drivers, passengers, and other motorists at risk. By not thoroughly understanding the intricacies of Nevada trucking insurance—from minimum coverage levels to the nuances of non-trucking liability—businesses risk not just their financial wellbeing, but their reputations and their future in a highly competitive market.

How Comprehensive Trucking Insurance Prevents the Most Expensive Mistakes in Nevada

Davis & Associates Insurance Agency LLC, an authority in trucking insurance, recognizes that coverage gaps are where financial calamities originate. Each policy type—be it cargo insurance for lost or damaged shipments, or commercial liability for third-party injuries—directly shields businesses from the all-too-real scenarios that cause unprepared companies to fold. By prioritizing comprehensive coverage, carriers can avoid the heartache of denied claims, business interruptions, and unanticipated legal fees stemming from overlooked liabilities.

The most pronounced benefit of Nevada trucking insurance lies in its flexibility and inclusivity. Whether you run a single truck as an owner-operator or oversee an expanding fleet, tailored protection addresses every risk: from accidental damage and theft to catastrophic accidents. Getting it right means a business can weather misfortunes—a totaled trailer, a major claim, or even a litigation—without losing its operational footing. Real-world relevance isn’t just about avoiding penalties: it’s about maintaining business continuity no matter what happens on the road.

Moreover, understanding the additional coverages, like trailer interchange or non-trucking liability insurance, assures drivers and owners that even less obvious risks—such as damage to non-owned trailers or driving off-hours—are accounted for. Smart insurance isn’t a burden—it’s the backbone of trust in client contracts, driver recruitment, and business negotiations throughout Nevada’s bustling trucking corridors.

Adapting to New Regulations: Why Nevada Truckers Can’t Afford Complacency

Regulations for trucking insurance in Nevada evolve continually—adjusting to national transportation trends, local legal precedents, and shifting risk landscapes. Truck operators who fail to track these changes can suddenly find themselves out of compliance, risking not only steep fines but also business shutdowns by state or federal agencies. In an industry shaped by both predictable and unforeseen hazards, keeping insurance policies current isn’t about ticking boxes; it’s a core operational discipline.

Accurate, up-to-date insurance is also critical when expanding services—from adding new routes or hauling different cargo types, to operating across state lines. Requirements for minimum coverage, liability limits, and proof of insurance can shift with each of these changes, meaning staying informed protects not only the bottom line but the very survival of the business.

How Proper Trucking Insurance Improves Driver Morale and Fleet Management

Trucking is more than logistics and invoices—it’s a people business. Proper insurance doesn’t simply safeguard rigs and goods; it reassures drivers that their jobs, health, and legal risks are acknowledged and covered. This signal of respect and professionalism boosts morale and loyalty. Trucking companies that invest in the best-fitting insurance, rather than the cheapest, set themselves apart as employers of choice—retaining quality drivers in a notoriously high-turnover industry.

Fleet managers also benefit from the peace of mind that comes with comprehensive protection; they can focus on optimizing routes, safety programs, and client relationships, instead of worrying about the financial repercussions of a single mishap. In the end, robust Nevada trucking insurance catalyzes better business management, reduces stress, and keeps teams focused on what matters: moving cargo safely and efficiently.

Spotting the Red Flags: Secrets to Evaluating Trucking Insurance Offers

Not all insurance policies are created equal. Overly generic plans, unclear exclusions, or abrupt premium hikes can signal a policy that won’t deliver when disaster strikes. The best Nevada trucking insurance comes with clear documentation, proactive communication, and a willingness to tailor protection as your business evolves. Seek out transparency: knowing precisely what is and isn’t covered means fewer surprises when it matters most.

A trustworthy insurance partner will thoroughly review fleet details and operational specifics—number of trucks, typical hauls, risks encountered—before recommending a policy. Quick quotes and low-cost promises are no substitute for a process rooted in listening and understanding. The most reliable agencies empower you with knowledge, giving clarity on required forms, claims processes, and how to dispute or update coverage to match your changing needs.

Davis & Associates Insurance Agency: A Nevada Perspective on Protecting Your Trucking Future

With deep experience serving Nevada’s diverse trucking sector, Davis & Associates Insurance Agency LLC brings a philosophy grounded in value, trust, and excellence. The agency doesn’t believe in a one-size-fits-all approach. Instead, the core mission is to provide insurance options that prioritize long-term security over short-lived cost cutting. From commercial auto to cargo, accidental, and general liability insurance, every policy is crafted to match the real risks Nevada carriers face daily.

Davis & Associates Insurance Agency LLC stands out for its straightforward, transparent process: from an initial needs assessment and free quote to diligent paperwork support. This sequence ensures fleets are road-ready without administrative headaches or hidden loopholes. The agency’s commitment to professionalism is evident in every interaction—whether a client manages one truck or a cross-state fleet. By being accessible and responsive, Davis & Associates Insurance Agency LLC cultivates lasting relationships built on security and mutual respect—qualities essential in such a high-stakes industry.

Underpinning this approach is a strong belief in maximizing value, never compromising on coverage quality. Drawing on access to over seventy insurance markets, the agency is able to secure competitive pricing without diminishing protection. It’s not just about weathering the storms—it’s about enabling Nevada truckers to thrive, confident they have expert advocates in their corner.

Real-World Results: A Trucking Insurance Experience That Builds Trust

The true measure of any insurance provider lies in how they serve clients facing uncertainty. When truckers hit obstacles—be it startup frustrations, paperwork snags, or confusion with claims—the value of patience and expertise becomes clear. The professionals at Davis & Associates Insurance Agency LLC have consistently shown their understanding and support during these pivotal moments, setting a standard for client care in Nevada’s trucking insurance landscape.

Dan and his associates (Brandon and Renette) were very honest, professional and patient with my situation and questions. I was frustrated with the startup insurance process and it was delaying and the cause ended up being on my banks end. They were very helpful is ascertaining the cause and remained very professional through my confusion and uncertainty. Glad I am doing business with a solid group and look forward to future business with Dan & Associates!

This testimonial highlights what successful companies gain from expert guidance: smoother processes, reduced stress, and lasting confidence. For those considering a change or refining existing coverage, it’s worth remembering that effective Nevada trucking insurance isn’t just about documents—it’s the peace of mind that comes with knowing experts are invested in your success and stability for the long haul.

Securing Tomorrow: Nevada Trucking Insurance as Your Business’s Best Investment

Navigating Nevada’s trucking insurance landscape isn’t a one-time task—it’s an ongoing commitment to risk management, compliance, and operational excellence. The right coverage shields a business from mistakes that could otherwise cripple progress, reputation, or even viability. Agencies like Davis & Associates Insurance Agency LLC play a leading role by combining expertise, personalized guidance, and robust policy options, giving truckers a distinct advantage on increasingly busy and regulated roads.

Achieving peace of mind and protecting future earnings both hinge on smart decisions made today about trucking insurance. By staying informed, leveraging the expertise of trusted partners, and demanding transparent, value-driven coverage, Nevada trucking companies can operate more securely and successfully—mile after mile.

Contact the Experts at Davis & Associates Insurance Agency LLC

If you’d like to learn more about how Nevada trucking insurance could benefit your trucking operation, contact the team at Davis & Associates Insurance Agency LLC.

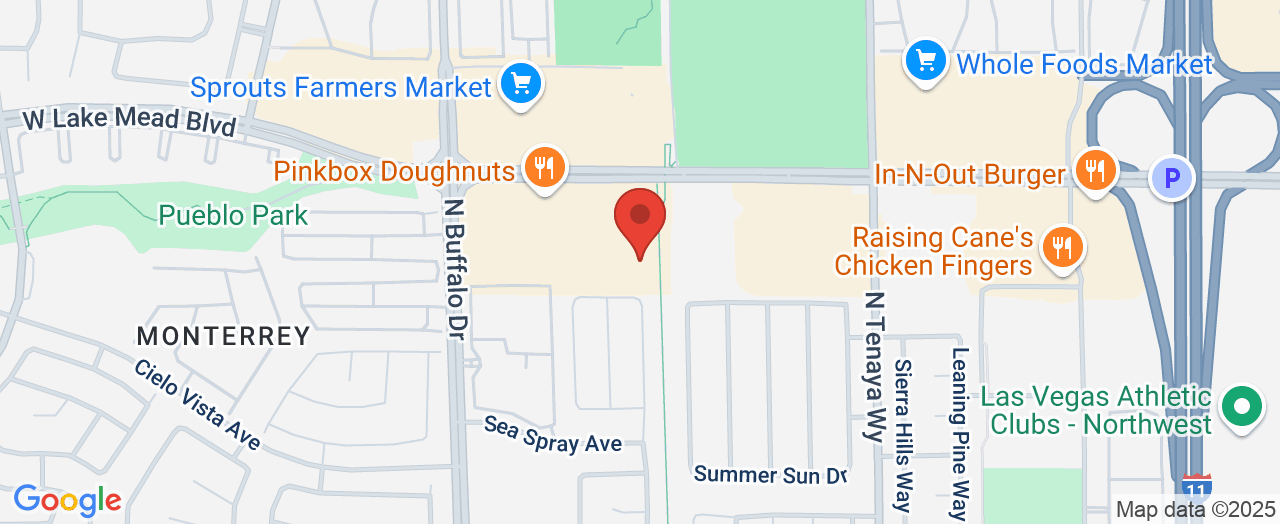

📍 Address: 7469 W Lake Mead Blvd, Las Vegas, NV 89128, USA

📞 Phone: +1 725-214-1521

🌐 Website: http://www.truckinginsurancenv.com/

Davis & Associates Insurance Agency LLC Location and Availability

🕒 Hours of Operation:

📅 Monday: 8:00 AM – 6:00 PM

📅 Tuesday: 8:00 AM – 6:00 PM

📅 Wednesday: 8:00 AM – 6:00 PM

📅 Thursday: 8:00 AM – 6:00 PM

📅 Friday: 8:00 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment