When Backlog Accounting Becomes a Risk: Why Delayed Books Spell Trouble for Any Business

Are bills overdue? Do receivables match expectations? Are you missing tax deductions or regulatory red flags hiding in old transactions? For many business owners, the stress tied to backlog accounting isn’t exaggerated—it can snowball from disorganization into costly errors, missed savings, and, at worst, lasting damage to the business’s future

The phrase “backlog accounting” refers not only to the accumulated, unposted transactions left unattended in your books but also to the entire suite of risks that unchecked accounting delays bring. Lost invoices, payroll confusion, and ambiguous cash flow all spawn from month-old figures. Without clear records, executives and owners often find themselves reacting to emergencies rather than planning strategically for growth. Understanding backlog accounting is essential for anyone who values financial health, as regaining control starts with demystifying exactly what’s at stake—and what’s possible—with proper oversight.

Backlog Accounting Explained: The Challenge Behind the Numbers

At its core, backlog accounting is the process of dealing with transactions—sales, expenses, payments—that haven't been recorded in the time frame they occurred. This issue might sound straightforward, but the implications reach much further. Every delayed entry can create a rift between what you think your finances look like and the actual reality. This disconnect impacts not just end-of-year reporting, but also monthly management of resources, vendor relationships, tax obligations, and even your ability to secure financing. Backlog accounting isn’t just a task for tax season; it’s an ongoing business risk management concern.

The anxiety caused by unresolved backlog accounting is often underestimated, particularly among small business owners who juggle multiple responsibilities. It’s easy to fall behind during busy periods or as your business scales up—and that’s when mistakes seep in. Unmatched accounts payable might mean vendors are left waiting or paid twice. Incomplete payroll records can cause compliance infringements and demoralize your team. Even when handled internally, backlog accounting requires experience to spot missed deductions, catch discrepancies, or keep up with evolving tax regulations. Without timely, precise bookkeeping, businesses are at the mercy of unforeseen audits, penalties, and cash shortfalls. Addressing backlog accounting is essential for those seeking a more stable, clear financial picture.

How Timely Accounting Rescues Businesses from Chaos: The Real Benefits of Clearing Backlogs Fast

Expert accounting professionals regularly see the transformations that happen when backlog accounting is brought up to date. The advantages go far beyond clean books—they touch every part of business operations. Accurate, current records mean business owners can confidently plan for growth, set realistic budgets, and take advantage of available deductions without fearing hidden surprises later on. Filing taxes accurately becomes less stressful, audits are far less intimidating, and lenders see your company as trustworthy and well-managed. By resolving backlog accounting, businesses avoid the trap of operating in the dark and reclaim their right to proactive, strategic decision-making.

Regularly updated records also streamline communication with suppliers, investors, and government agencies, ensuring everyone is on the same page. Unattended backlogs lead to confusion and inefficiency; by comparison, up-to-date accounting allows for smoother payroll, stable cash flow, and reliable financial reporting. In an era where regulatory demands and financial transparency are more stringent than ever, clearing backlog accounting is more than a procedural fix—it’s a safeguard for the integrity and sustainability of the enterprise. Guidance from professionals adept in untangling complex, historical financial records not only addresses errors but builds resilience for the future, freeing leaders to focus where they’re needed most.

Unpacking the Dangers of Delayed Bookkeeping: Backlog Accounting’s Ripple Effect on Small Business Health

When backlog accounting goes unaddressed, the negative consequences stack up relentlessly. Eventually, delayed entries cascade into further administrative headaches: reconciling bank statements becomes a guessing game, balance sheets lose their reliability, and cash flow projections turn speculative. Worse yet, inaccurate or missing records expose a business to the hazards of incorrect tax filings or missed statutory deadlines—mistakes that can result in fines or costly audits. For any business, especially smaller operations with limited resources, the pressure caused by unfinished accounting can erode employee trust, undermine relationships with vendors, and make leadership decisions far riskier.

Staying on top of accounting isn’t about micromanagement—it’s about creating a foundation for trust, both within a business and with its external partners. The longer backlog accounting remains unresolved, the more likely it is that small errors warp into entrenched problems, ultimately making the road to recovery more challenging and costly. Business owners who recognize the warning signs early and seek to address backlogged accounts position themselves for stability, regulatory compliance, and long-term growth.

From Procrastination to Precision: Simple Steps to Overcome Backlog Accounting

The first step is acknowledging the scope of the delays—how far back does the backlog go, and what records are missing or incomplete? From there, establish a timeline and prioritize the most time-sensitive or regulatory-required entries, such as payroll or tax-related documentation

Many businesses benefit from seeking outside expertise precisely because professionals bring objectivity, structure, and proven systems. Engaging experienced accountants to catch up on backlogged records ensures accuracy, reduces the risk of repeated errors, and brings fresh insight to entrenched issues. With the right approach and sequence, even substantial backlog accounting can be brought under control, transforming what once felt overwhelming into a foundation for smarter, more confident business management.

An Industry Perspective: Thoughtful, Reliable Approaches to Backlog Accounting

Full-spectrum accounting firms set themselves apart through dedication to accuracy, transparency, and personalized guidance. By focusing on client education and accessibility, firms demonstrate the importance of demystifying accounting concepts, ensuring that clients understand their records and obligations—not just the numbers themselves. Professionalism and patience are core values, especially when resolving delicate issues like backlog accounting, where judgment-free assistance makes all the difference for anxious business owners.

Trusted advisors continually emphasize clarity and accessibility in financial communication. The willingness to explain every step, empower clients through knowledge, and offer hands-on support for both routine matters and crisis resolution, is emblematic of a thoughtful approach to accounting. Experience in handling complex, multi-entity backlog situations with discretion and confidence further reinforces the crucial role expert guidance plays in restoring accounts to order and building a pathway toward future resilience and growth.

When Expertise Really Delivers: Real Clients Find Relief in Professional Backlog Accounting Support

Many business owners approach backlog accounting with understandable hesitation—until they experience firsthand the confidence and clarity brought by trusted accounting professionals. Recent client experiences provide insight into how proper guidance can transform apprehension into peace of mind:

I recently hired Business Financial Group to manage both my personal and business taxes and have been extremely impressed. My initial consultation was with Estaban who was professional, transparent, and consistently responsive from the start.He clearly explained options, followed through without exception, and handled a more complex, multi-entity situation with confidence and discretion. Pricing was straightforward and very reasonable for the level of expertise and attention provided.I feel confident working with Business Financial Group long term and highly recommend them to anyone looking for a reliable, client-focused accounting partner.

From the stress relief of knowing that backlogged records are now accurate to the appreciation for clear communication and reasonable pricing, it’s clear that resolving backlog accounting isn’t just about numbers—it’s about trust, understanding, and feeling empowered in financial decisions. Others seeking similar relief and assurance can be confident that addressing backlog accounting offers tangible improvements to both their peace of mind and bottom line.

Why Timely Bookkeeping is the Keystone to Financial Well-Being and Growth

Backlog accounting, though common, is a risk no business can afford to ignore for long. By keeping records current and addressing accounting backlogs as soon as possible, businesses protect themselves from avoidable stress, errors, and financial setbacks. Equally, they empower themselves to pursue new opportunities with the confidence of accurate, up-to-date information. Knowledgeable accountants contribute far more than compliance—they provide the structure and reassurance essential for sustainable growth and organizational health. Tackling backlog accounting is an essential fix for anyone committed to long-term business success and operational peace of mind.

Contact the Experts at Business Financial Group

If you’d like to learn more about how backlog accounting could benefit your financial management, contact the team at Business Financial Group.

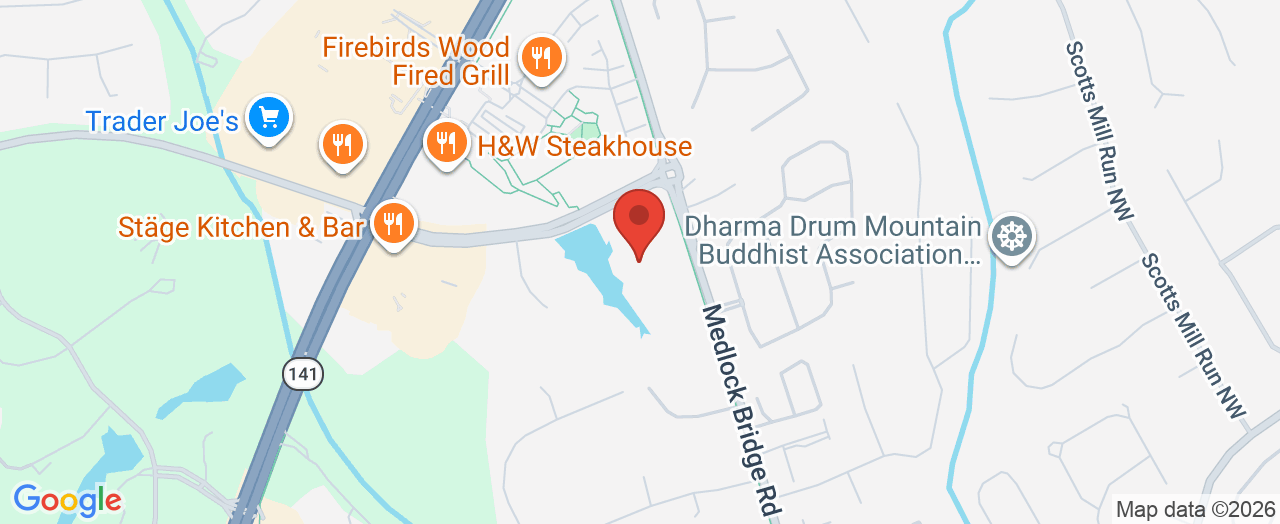

📍 Address: 5051 Peachtree Corners Cir Suite 200, Norcross, GA 30092, USA

📞 Phone: +1 678-257-2116

🌐 Website: https://www.businessfinancialgroup.biz/

Business Financial Group Location and Hours

🕒 Hours of Operation:

📅 Monday: 9:00 AM – 5:00 PM

📅 Tuesday: 9:00 AM – 5:00 PM

📅 Wednesday: 9:00 AM – 5:00 PM

📅 Thursday: 9:00 AM – 5:00 PM

📅 Friday: 9:00 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment