Ever wondered what Blockchain really is and how it POWERS Cryptocurrencies? Understanding this technology can unlock NEW financial opportunities and security breakthroughs. Dive in to explore how Blockchain shapes our digital future and why MASTERING it matters more than ever. I LOVE it Myself... ;>)

Unlocking Blockchain: Understanding What is Blockchain and Its Core Technology

"Understanding Blockchain Technology can unlock NEW financial opportunities for YOU and family. Explore how Blockchain shapes our digital future. MASTERING it matters NOW more than ever before..."

What You'll Learn in This What is Blockchain Guide:

Clear definition of what Blockchain IS

How Blockchain Technology secures Cryptocurrencies and other Digital Assets

Distinction between Public and Private Blockchains

Uses of Blockchain Networks and Smart Contracts in real-world applications

Key concepts: Distributed Ledger, Proof of Stake, Proof-of-Work, Public Key

-

Security benefits and challenges of Blockchain Technology

Blockchain Technology has taken the digital world by storm, empowering Cryptocurrencies like Bitcoin, enabling secure and Decentralized data sharing and driving innovation in countless industries. But what is Blockchain, really? This foundational technology is transforming how we exchange value, store records and manage Digital Assets. Understanding it is crucial for anyone interested in the future of finance or Digital Security. Right from powering Decentralized Networks to enabling transparent and nearly unhackable systems, Blockchain is a game-changer. If you’re ready to grasp these concepts WITHOUT the tech jargon, you’re in the right place. Let's break down what is Blockchain, HOW it works, and WHY it could be essential for your financial future.

What is Blockchain? The Foundation of Modern Blockchain Technology

Defining What is Blockchain in Simple Terms

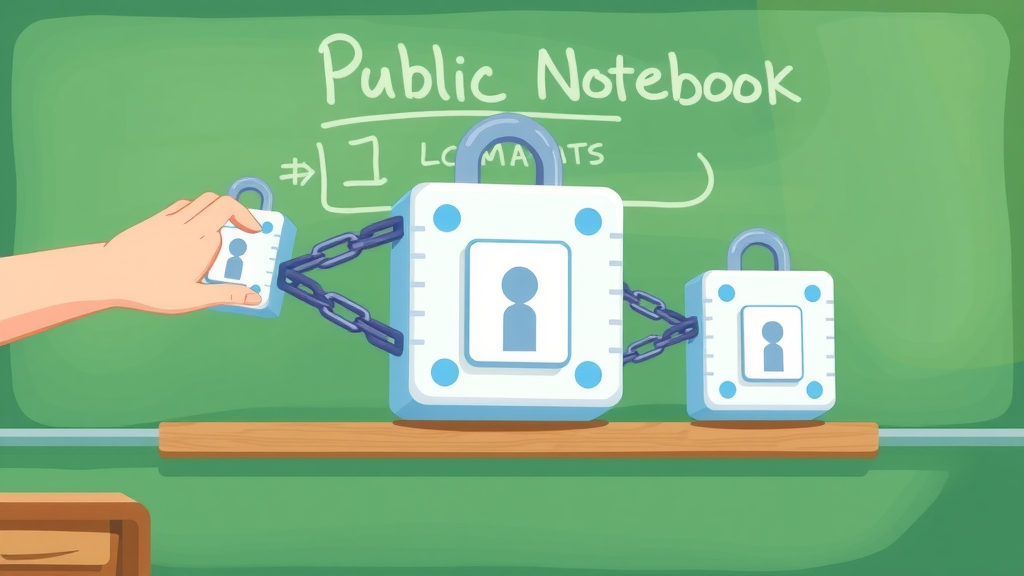

At its core, Blockchain is a secure and transparent Digital Ledger technology. Imagine a digital notebook, shared across a massive Network of computers. Every time someone adds a new record—like a Transaction or Contract—it’s placed in a “block”. Each block is linked to the previous block using Advanced Cryptography, forming a continuous “chain.” This makes it nearly impossible to change past information without altering every subsequent block, which a majority of the Network would detect and reject.

Unlike old-school ledgers or databases that CAN be altered, a Blockchain Network is designed to be immutable and Decentralized. There is NO single owner; instead, many users help maintain the record. This is why Blockchain is so powerful for Digital Assets, Cryptocurrencies and secure record-keeping applications. From financial services to Supply Chain Management, the Blockchain Technology model is trusted for its reliability and transparency.

How Does Blockchain Technology Work?

Blocks, Chains and Cryptography: How they interact

Role of Public Key and Distributed Ledger

Benefits and limitations of Blockchain Technology

When we examine HOW Blockchain Technology works, it starts with blocks that carry batches of transactions or data. Each block is securely connected to the one before it through a coded reference called a Cryptographic Hash. This connection ensures that if anyone tried to tamper with a block, the entire Chain Network would instantly notice the discrepancy. The process uses both Public Keys and Private Keys for added security and to prove the identity of participants.

Blockchain relies on a Distributed Ledger—a synchronized record that is duplicated across multiple computers in the Network. Changes to the Ledger, such as new transactions, require agreement (called “Consensus Mechanism”) among Network participants. While Blockchain Technology delivers increased security, decentralization and transparency, it can also face limitations like scalability issues and high energy consumption (especially in Proof-of-Work Systems like Bitcoin). Nevertheless, its ability to validate Transactions in a secure and verifiable way is revolutionizing industries worldwide.

A Brief History of Blockchain Technology for Beginners

Milestones in Blockchain Evolution

Blockchain Technology didn’t appear overnight. Its earliest development can be traced back to Cryptographic Research in the 1980s and 1990s, but it gained real traction in 2008 when “Satoshi Nakamoto” published the Bitcoin White Paper. This was the first time Blockchain was practically used to solve the problem of Digital Currency double-spending WITHOUT a trusted third party. Over the last decade, Blockchain’s milestones include the launch of Ethereum, which introduced Smart Contracts and expanded Blockchain’s use cases beyond Digital Currency, as well as the development of Private and Consortium Blockchains for Supply Chain and Financial Service applications.

Blockchain now underpins many aspects of Digital Asset and Supply Chain Networks, providing the transparency and security that businesses demand. The rise of Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs) and scalable Blockchain Protocols are just a few examples of its evolution.

Bitcoin: The First Real-World Blockchain Network

The launch of the Bitcoin Blockchain marked a pivotal moment in the world of Financial Technology. As the first Decentralized Cryptocurrency, Bitcoin used a Public Blockchain Network to transfer value safely and transparently across the globe, allowing users to send Digital Currency Peer-to-Peer with NO central authority.

Bitcoin Transactions are stored on the Blockchain, each verified using Blockchain Technology’s Consensus Mechanisms (initially the “Proof of Work” system). Today, while NEW Blockchains may use alternative Consensus Models like “Proof of Stake,” Bitcoin remains an iconic example proving how Blockchain can redefine trust and value transfer in the Digital Era.

"Without understanding its history, you CAN'T predict the future of Digital Assets."

How Blockchain Works: The Science Behind the Blockchain Network

The Structure: Distributed Ledger in Blockchain Networks

One crucial characteristic of a Blockchain Network is its use of a Distributed Ledger. Unlike a typical database that resides on a central server, a Distributed Ledger is a synchronized record replicated across the entire Chain Network. Each participant, or Node, has a COPY of the Ledger, making unauthorized changes extremely difficult—a single altered record would conflict with thousands of others.

This distributed structure dramatically increases transparency and trust in the system. Any addition, such as a Digital Asset Transaction, must be agreed upon (or “validated”) by Consensus. The integrity of the Blockchain is protected by linking each record to the previous Block through Cryptographic Signatures, creating a tamper-resistant chain that underpins everything from Cryptocurrencies to Smart Contracts in Financial Services and Supply Chains.

Public Key Cryptography and Network Security

Importance of Public Key for Digital Asset Protection

Role of Cryptography in Blockchain Technology

The security backbone of every Blockchain Network relies on Public Key Cryptography. Each participant controls a Private Key (kept secret) and a Public Key (shared openly). When you want to send Digital Assets—like Cryptocurrency—your Private Key digitally signs the Transaction, while the Public Key allows others on the Blockchain Network to validate it, ensuring ONLY the owner can move those Assets.

Cryptography not only ensures the authenticity of Digital Asset Transfers, but also guarantees the integrity of the data stored on the Blockchain. This layered security model reduces fraud and unauthorized access across both Public and Private Blockchains, making Blockchain solutions ideal for SECURE Digital Transactions, Supply Chain Management and even sensitive government or healthcare applications.

Consensus Mechanisms: Proof of Stake and More

How do Blockchain Networks agree on what’s “true” without a central authority? They use Consensus Mechanisms. The most famous is “Proof of Work” (as pioneered by Bitcoin Blockchain), where computers compete to solve complex mathematical puzzles and are rewarded for Validating Transactions. However, this system requires HUGE energy resources.

“Proof of Stake” offers a more energy-efficient alternative, allowing Validators to participate based on the amount of Digital Currency they “stake” or lock up. This method, used in newer Blockchain Technologies like Ethereum 2.0, enhances security, reduces energy consumption and supports Network scaling. Other mechanisms, including Delegated Proof of Stake and Byzantine Fault Tolerance, continue to emerge, giving Blockchain Protocol Developers flexibility, depending on the Application’s needs.

Private Blockchain vs. Public Blockchain vs. Consortium Blockchain Networks

Blockchain Type |

Access |

Control |

Use Case |

|---|---|---|---|

Public Blockchain |

Open to all |

Decentralized |

Cryptocurrencies |

Private Blockchain |

Restricted |

Centralized/Enterprise |

Supply Chain Management |

Consortium Blockchain |

Selected Validators |

Partially Decentralized |

Multiple Enterprises |

"Blockchain Networks can be Public and open or Private and exclusive, depending on their Protocol."

Key Components: Digital Asset Management Through Blockchain Technology

What Are Digital Assets and How Does Blockchain Secure Them?

Digital Assets—like Cryptocurrencies, Coins, Tokens and Data Records—are at the heart of most Blockchain Applications. Unlike Physical Assets, Digital Assets are intangible, which makes their Secure Management paramount. Blockchain provides this security by recording Asset Ownership in an unchangeable Digital Ledger, protected by Cryptography and Network Consensus.

Whenever a Digital Asset is transferred or sold, the Transaction details are stored on the Blockchain, visible to all, but ONLY alterable with the right Cryptographic Keys. This transparency helps prevent fraud, double-spending and unauthorized Asset manipulation, essential for Financial Services, Supply Chains and global trading Networks.

The Rise of Crypto: Digital Assets and Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are perhaps the most well-known Digital Assets managed on Public Blockchains. They allow peer-to-peer value transfers in a trustless manner—meaning users do NOT need to trust any central authority to verify their Transactions.

The underlying Blockchain Technology validates transactions through Consensus (often Proof of Work or Proof of Stake), records them permanently and keeps a transparent history of every coin’s movement. This ensures a level of security and efficiency previously unavailable in traditional banking, making Digital Assets a revolutionary force in global finance.

Smart Contract Innovation and Automation

How Smart Contracts automate Digital Asset Transfers

Benefits to Financial Services and Supply Chains

Reducing fraud in Blockchain Networks

A Smart Contract is a self-executing program stored on a Blockchain, triggered automatically when certain conditions are met. Imagine an Escrow Agreement or a complex Business Transaction that executes itself—no lawyers or delays required. This automation reduces costs, eliminates human error and dramatically improves the reliability of Digital Asset Transfers.

In Supply Chains and Financial Services, Smart Contracts are used to automate delivery payments, handle document verification and streamline cross-border transactions. Their transparent and tamper-proof nature helps reduce fraud, enhances trust and makes Blockchain Technology appealing for ANY industry seeking efficient, secure automation.

Public Blockchain, Private Blockchain, Consortium: Types of Blockchain Networks

Differences Between Public Blockchains, Private Blockchains and Consortium Chains

NOT all Blockchains are created equal. Public Blockchains are open to anyone: Anyone can participate, Validate Transactions and read the Ledger. Private Blockchains, on the other hand, restrict access to known participants, allowing enterprises to keep transactions confidential and maintain more control. Consortium Blockchains bring together a group of Organizations, sharing control and validation among trusted parties in Supply Chains or Industry Groups.

Each type serves specific needs: Public for transparency and Decentralized Digital Assets (think Bitcoin); Private for secure Enterprise operations; and Consortium for collaborative Industry solutions—especially in multi-party Supply Chain Networks.

Use Cases: From Digital Asset Security to Global Supply Chain Networks

Public Blockchains in Cryptocurrency and Digital Assets

Private Blockchains in Enterprise Operations and Supply Chain

Consortium Chains for Multi-Party Collaboration

Public Blockchains are used for OPEN Digital Currencies and Decentralized Applications. Private Blockchains offer Enterprises a way to manage confidential Contracts, streamline Supply Chains and secure internal processes. Consortium Blockchains are gaining traction in industries like Banking and Logistics, where different Stakeholders—like manufacturers, shippers and retailers—need a shared, transparent Ledger but DON'T want to expose data to the world.

This diversity enables Blockchain Solutions to fit a WIDE range of applications, from Digital Asset Exchanges to Enterprise-Grade Chain Networks, driving the adoption of Blockchain Technology across the board.

Blockchain Protocols: The Rules and Standards Guiding Blockchain Technology

Popular Blockchain Protocols and Their Differences

Every Blockchain Network is governed by its Blockchain Protocol—the set of Rules and Standards defining how participants Validate Transactions, maintain Consensus and ensure Network Security. The Bitcoin Protocol, for example, uses Proof of Work and has a limited Supply Cap. Ethereum uses a Protocol allowing for Smart Contracts and Decentralized Applications (dApps).

Other major Protocols include HyperLedger (used in many Private Chain Networks), Cardano, and Ripple, each tailored for different Use-Cases, from banking to real-time payments. Choosing the RIGHT Blockchain Protocol affects everything from Transaction speed to energy efficiency and the types of Smart Contracts or Digital Assets you can create.

Why Blockchain Protocols Matter for Security and Innovation

A well-designed Blockchain Protocol not only provides the foundation for secure data management but also fosters innovation. As NEW threats emerge—like Quantum Computing or sophisticated Hacking—Blockchain Protocols need to be updated to safeguard Digital Assets and secure Transactions. They also enable new features, like Advanced Smart Contract Automation or faster confirmation speeds for Financial Services and Digital Asset exchanges.

"A Blockchain Protocol is like the Rulebook for Digital Transactions and Asset Management."

Blockchain Security & Trust—Public Key, Distributed Ledger and More

How Blockchain Secures Digital Assets With Public Key Infrastructure

Blockchain Technology is built for TRUST. Public Key Infrastructure is at the core, assigning each participant a secure Public/Private Key Pair. When a transaction is created, it’s Signed by a Private Key and broadcasted to the Blockchain. The Network Verifies this Signature using the Public Key, ensuring authenticity and preventing fraudulent transactions.

This Digital Asset Protection Model means only genuine Owners can Authorize Transfers, greatly reducing theft, fraud or misuse. That’s why Blockchain Networks are rapidly being adopted for managing everything from Cryptocurrency to Property and Supply Chain Records.

Distributed Ledger's Role in Secure Blockchain Networks

The distributed nature of the Blockchain Ledger ensures that NO single point of failure exists. If one Node in the Blockchain Network is compromised, the rest of the Distributed Ledger remains unaffected, robustly securing the historical record of Digital Assets and Chain Solutions. The combination of Distributed Networks, Consensus and Cryptographic Protection offers a Security Model unrivaled by traditional databases.

This system not only prevents unauthorized changes but also provides unparalleled transparency. Whether in Cryptocurrencies, Supply Chains or Digital Identity Management, the Distributed Ledger is the backbone of Blockchain Security.

Proof of Stake vs. Proof of Work: Security and Efficiency

Blockchain Networks reach Consensus through different methods, with “Proof of Work” (PoW) and “Proof of Stake” (PoS) being the most notable. Proof of Work involves Miners solving complex mathematical puzzles to add new Blocks—a process that secures the Network but consumes vast amounts of electricity (as seen in the Bitcoin Blockchain).

Proof of Stake, alternatively, selects Validators based on the AMOUNT of Cryptocurrency they Stake, reducing energy usage and offering faster Transaction speeds. Both mechanisms have their security benefits: PoW is time-tested and robust, while PoS is efficient and accessible—guiding Blockchain Technology toward scalable and green solutions for the digital future.

Blockchain in Real Life: Use Cases and Industry Applications

How Blockchain Technology Revolutionizes Supply Chains

Supply Chain Management is one of the most impactful real-world Blockchain applications. Traditional Supply Chains often suffer from lack of visibility and delayed communication. By recording every Transaction on a Distributed Ledger, Blockchain provides end-to-end transparency, helps track item provenance and automates trust between parties.

From food safety recalls to verifying luxury goods or automating shipping and delivery, Blockchain-Powered Supply Chain Networks can transform efficiency and reduce fraud. This real-time visibility also helps companies quickly spot discrepancies and resolve them, benefiting finance, manufacturing, logistics and beyond.

Smart Contracts in Financial Services and Everyday Operations

Smart Contracts are changing the landscape of Financial Services by automating routine processes like payments, loans or insurance settlements. The result? Faster, safer and cheaper Transactions, with transparency built-in to every step. Financial Services providers also use Blockchain Applications to automate regulatory compliance, reduce settlement times and improve overall customer trust.

Outside Finance, Smart Contracts manage Utility Payments, Digital Rights and even Real Estate deals—eliminating costly middlemen and reducing error rates across operations.

Digital Asset Management: From Crypto to NFTs

Digital Asset Management is no longer just about Cryptocurrencies. Blockchains now power NFTs (Non-Fungible Tokens), Digital Collectibles, Intellectual Property and even Tokenized forms of Real Estate or Art. Each Asset is uniquely identified, tracked and traded securely, with Ownership histories verifiable On-Chain.

For both individual users and enterprises, Blockchain formats a Digital Asset’s journey from creation to transfer, ensuring authenticity and reducing counterfeiting or data loss.

Improving Transparency, Efficiency and Trust Through Blockchain

Top Supply Chain Use-Cases

Real-life Digital Asset examples

Financial Service transformations

From pharmaceuticals verified in seconds, to Artists selling digital originals (NFTs), Blockchain builds trust and accountability. Transparent data sharing, minimal fraud, faster payments and real-time Auditing are transforming how Global Business and Personal Finance operate.

How to Get Started with Blockchain: Resources for Investors and Traders

Choosing the Right Blockchain Network

As a beginner or aspiring Investor, your Blockchain journey starts with choosing the right Blockchain Network. Consider your goals: Are you interested in Cryptocurrencies, Digital Asset Trading, or Enterprise Blockchain Solutions? Research Public Blockchains like Bitcoin or Ethereum for open, accessible Digital Assets, or look to Private/Consortium Networks for Enterprise use.

Key factors for decision-making include Transaction Fees, Security mechanisms, Network size and supported Digital Asset types. It’s also WISE to explore documentation, User Communities and the long-term stability of each Blockchain Protocol. This foundational step will help you AVOID costly mistakes and leverage the best of Blockchain Technology.

Assessing Digital Asset Security

Your Digital Asset’s Security relies on both Blockchain Network Protocols and your personal practices. Always use reputable Exchanges or Digital Wallets, protect your Private Key with STRONG Passwords and Backups and enable Multi-Factor Authentication whenever possible. Stay informed about emerging security threats and maintenance of Software Wallets or Hardware Devices.

NEVER share your Private Key and regularly audit your Digital Asset Portfolio—especially as the Blockchain world continually evolves.

>>> https://MillionDollarCryptoSecurity.com

Understanding Cryptocurrency Wallets

Key considerations for beginners

Best practices for securing Digital Assets

Cryptocurrency Wallets are the digital equivalent of a physical wallet—holding your Private and Public Keys for sending, receiving and storing Digital Assets. Options include Hot Wallets (software, connected online) and Cold Wallets (hardware, OFFLINE). Beginners should use only well-reviewed solutions, maintain Backups of their Digital Wallet “Seed Phrases” and NEVER store Private Keys in easily accessible or online places.

>>> https://MillionDollarCryptoTools.com

Best practices: Use Hardware Wallets whenever possible, keep software updated and double-check addresses before sending funds. A lost or compromised Private Key could mean losing your Digital Assets forever.

>>> https://MillionDollarCryptoTips.com

Common Questions: What is Blockchain? (People Also Ask)

What is Blockchain, in Simple Words?

Blockchain is like a digital notebook that’s shared with everyone on a Network. Every page (Block) records Transactions, and once a page is filled, it’s locked in and linked to the previous Block. This Chain of Blocks makes it nearly impossible to change or fake a record.

Simple Definition: Blockchain is a secure, digital record-keeping technology where information is grouped into Blocks, linked together and protected by Cryptography, making it nearly impossible to alter or hack.

Is Blockchain a good or bad thing?

Blockchain is generally viewed as a good thing for enabling secure, transparent and efficient Transactions. It increases trust and reduces fraud in industries like Finance and Supply Chain Management. However, it does have downsides, such as high energy use in some Networks (like Bitcoin) and potential misuse in illegal activities. The consensus: its benefits outweigh the drawbacks for most legitimate uses.

What is a Blockchain, for dummies? LOL

For beginners, a Blockchain is like a public, digital notebook that everyone can see and trust. Each transaction is double-checked by many Network Members, and once it’s written down, nobody can erase it.

What are the 4 types of Blockchain?

The four types of Blockchain are: Public Blockchain, Private Blockchain, Consortium Blockchain and Hybrid Blockchain. Each type offers different access control and Decentralization, suitable for a variety of use cases—from open Cryptocurrency Networks to private Enterprise Solutions.

FAQs about "What is Blockchain"

-

What makes Blockchain Technology unique?

Blockchain’s main advantage is its Decentralized and tamper-resistant architecture—NO single party can cheat or alter the records, making it highly trustworthy. -

Can Public Blockchains be hacked?

While theoretically possible, Public Blockchains are extremely secure due to thousands of independent Nodes verifying each record. Attacks are costly and rare. -

Are Blockchain Networks truly Decentralized?

Most Public Blockchains ARE, but Private and Consortium Blockchains may centralize control among select participants for specific use-cases. -

How does Proof of Stake differ from Proof of Work?

Proof of Work rewards Network Security through computational work (Mining), while Proof of Stake chooses Validators based on their Cryptocurrency holdings, saving energy. -

Why are Smart Contracts important?

Smart Contracts automate Agreements, reduce manual intervention, cut costs and minimize fraud—powering a new wave of Blockchain Applications in Finance, Supply Chain and more. -

What are Digital Assets and how do they work?

Digital Assets are units of value stored on Blockchains (like Cryptocurrencies, Coins, Tokens or NFTs). Their Ownership and Transactions are managed via Cryptographic Keys and Network Consensus.

Key Takeaways from "What is Blockchain" and Blockchain Technology

Blockchain Technology enables Decentralized, secure Data Management

What is Blockchain: A transparent Ledger for Digital Assets and Cryptocurrencies

Smart Contracts and Proof of Stake improve security and efficiency

Used in Financial Services, Supply Chain Management and Digital Asset Protection

Conclusion: Why Understanding What is Blockchain is Essential for the Digital Future

The Importance of Blockchain Technology for Beginners and Investors

Mastering Blockchain Technology can open new opportunities, BOOST your Digital Security and help you ride the next wave of financial innovation.

The Ongoing Evolution of Blockchain Networks

Blockchain Networks continue to evolve, bringing more secure, transparent and user-friendly solutions for Digital Asset Management and beyond.

Begin your Digital Asset journey today—Blockchain is transforming our world!

Take Action: Ultimate Crypto Security & Digital Asset Protection

Discover the Ultimate Crypto Security & Digital Asset Protection—Start Now:

Learn Crypto Security & Digital Asset Protection w/ the OmniTech Crypto Security Guide HERE:

>>>>> https://MillionDollarCryptoSecurity.com

Sources

https://blockchain.com/learning-portal – Blockchain.com Learning Portal

https://www.ibm.com/blockchain/what-is-blockchain – IBM Blockchain Explained

https://www.investopedia.com/terms/b/blockchain.asp – Investopedia Blockchain

Blockchain Technology has evolved significantly since its inception, offering a Decentralized and secure method for recording Transactions. For a comprehensive understanding, consider exploring the following resources:

“What Is Blockchain Technology? » Explained”: This article provides a high-level overview of Blockchain, detailing its structure, benefits, and various applications across industries. (chain.link)

“What is Blockchain? Definition, Examples and How it Works”: This resource delves into the mechanics of Blockchain, offering definitions, real-world examples and insights into its operational framework. (techtarget.com)

These articles will enhance your understanding of Blockchain Technology, its functionalities and its impact on various sectors.

Add Row

Add Row  Add

Add

Write A Comment