Why Your Online Checkout is a Make-or-Break Moment for Ecommerce Payment Processing

Imagine browsing an online store, adding products to your cart, only to stumble at the final hurdle—an awkward, confusing, or error-prone payment process. Recent studies show that nearly 70% of online shopping carts are abandoned, with many shoppers blaming failures or frustrations during checkout. At the heart of every seamless digital transaction lies robust ecommerce payment processing, quietly orchestrating security, speed, and trust. Yet, this pivotal system often becomes an afterthought for growing ecommerce businesses—until payment failures, delays in funds, or chargeback complications start hurting the bottom line.

Understanding the art and science behind ecommerce payment processing is vital for online retailers, especially those operating in high-risk industries. Today's consumers expect instant, secure, and flexible payment options tailored to their preferences. A single glitch can not only cost a sale but can damage a brand's reputation and invite costly fraud or chargeback threats. As ecommerce continues its rapid ascent, the challenge is balancing convenience with compliance, safeguarding data while offering easy checkouts, and equipping businesses to scale without sudden shutdowns or security breaches. This is the crossroads many ecommerce leaders now face—where payment infrastructure is no longer optional but mission critical.

What Every Business Needs to Know: Inside the Complex World of Ecommerce Payment Processing

Ecommerce payment processing encompasses the entire journey of accepting, transmitting, and settling digital payments between customers and online merchants. From the customer's card swipe or digital wallet, every detail is encrypted, verified, and routed through a labyrinth of gateways, acquiring banks, and fraud detection engines. But as online retail surges, failing to grasp the nuances of payment processing can leave businesses exposed. For merchants, payment processing is more than a technical back-end; it’s a nerve center that supports everything from checkout conversions to customer trust and long-term loyalty.

Many are unaware that ecommerce payment processing also involves strict regulatory standards, fraud prevention protocols, and system integrations that must all work together flawlessly. Overlooking critical elements—such as chargeback management, PCI compliance, or seamless shopping cart integration—invites serious pitfalls. The stakes are even higher for high-risk merchants, where traditional processors might reject applications, freeze funds, or close accounts with little warning. Errors here are not just technological—they’re financial and reputational, affecting revenue, customer relationships, and a business’s ability to grow. If you’ve underestimated the complexity or value of ecommerce payment processing, the risk isn't just lost sales; it's potentially losing the trust that future success depends on.

How Advanced Ecommerce Payment Processing Minimizes Risk and Maximizes Business Results

Among the voices shaping the future of digital commerce, PaymentCloud stands out for its deep understanding of what high-risk merchants need in ecommerce payment processing. Rather than avoiding complex industries, the PaymentCloud platform offers fast approvals, secure protocols, and infrastructure specifically tailored for high-risk sectors ranging from CBD to dropshipping. Their approach addresses the real problems online sellers face: sudden processor shutdowns, fraud, data breaches, and lost revenue due to clunky checkout experiences.

The benefits extend far beyond technical reliability. Utilizing advanced risk management tools, PaymentCloud’s platforms help merchants proactively detect and prevent chargebacks and scams—one of the leading causes of revenue loss for ecommerce operators. Flexible, competitive pricing without long-term contracts gives even newer merchants room to grow, while 24/7 personalized industry-savvy support helps navigate shifting regulations and standards. For any ecommerce merchant, especially those regularly turned away by mainstream processors, this isn’t just a payment tool; it's a business safeguard and growth engine all-in-one.

Why Checkout Integration and API Flexibility Matter More Than Ever

Today’s ecommerce landscape is driven by a vast ecosystem of software, shopping carts, and payment gateways. Seamless integration is critical—not just for speed and convenience, but to ensure uptime and security across every transaction. PaymentCloud emphasizes compatibility with popular ecommerce platforms such as Shopify, WooCommerce, BigCommerce, Magento, and others, granting merchants easy setup and robust payment acceptance regardless of the tech stack.

Flexible API tools and integrations with leading gateways like Authorize.net and NMI empower online businesses to tailor customer experiences and streamline back-end operations. Whether a startup configuring a first online cart or an enterprise migrating multiple sites, the ability to connect with shipping, inventory, and analytics solutions through secure, scalable payment APIs is a distinct market advantage. In an environment where even a brief outage or glitch can cost thousands, integration flexibility isn’t just convenient—it’s essential for operational resilience and sustained ecommerce growth.

The Increased Risks for High-Risk Merchants—and How Smart Payment Processing Addresses Them

High-risk industries face added scrutiny, regulatory burdens, and greater vulnerability to fraud and chargebacks. For these businesses, the right ecommerce payment processing solution must actively manage risks without creating friction for customers. PaymentCloud is uniquely built for this challenge, embedding machine learning, two-factor authentication, and real-time behavioral insights directly into its payments infrastructure.

Merchants gain peace of mind from knowing that every transaction is monitored by advanced security measures, reducing false declines and unauthorized transactions. Furthermore, PaymentCloud’s flexible underwriting standards, competitive rates, and absence of punishing contracts offer a rare pathway for businesses usually denied by traditional providers. For business owners juggling sensitive regulatory constraints or rapid growth, this smarter approach to ecommerce payment processing is more than a technical solution—it safeguards business continuity and opens doors to new markets.

The Power of Choice: Payment Method Diversity Drives Higher Conversion Rates

Today’s consumers expect options at checkout—credit and debit cards, mobile wallets, ACH transfers, and even eChecks. Limiting payment methods can mean losing sales, especially amongst customers with strong preferences or regional requirements. PaymentCloud supports a comprehensive range of online and in-person payment options, ensuring that merchants can serve every customer, however they wish to pay.

From integrated card acceptance in both retail and online environments to the convenience of mobile payments, MOTO (Mail Order/Telephone Order) for remote sales, and direct ACH/eCheck transactions for large, recurring, or B2B payments, diversification is key. The platform’s support for same-day ACH settlements and paperless processing removes common barriers and administrative overheads, further optimizing revenue flow while enhancing the customer experience. In a hyper-competitive ecommerce world, this breadth of payment solutions offers merchants a valuable edge.

PaymentCloud’s Philosophy: Empowerment, Security, and Scalability for Ecommerce Merchants

At the core of PaymentCloud’s approach lies a philosophy of inclusion and empowerment for high-risk online businesses—a sector too often underserved or rejected by legacy payment providers. PaymentCloud’s infrastructure is intentionally built to embrace businesses that others label as risky, powering their growth with guaranteed access to merchant accounts and fast, secure approvals.

Security is engineered into every layer of the payment process. From machine learning-driven fraud analytics to PCI-compliant gateways and two-factor authentication, the platform’s security-first mindset protects merchants against evolving threats without sacrificing ease of use. There’s a keen focus on adaptability; tools are designed to scale with businesses of every size, ensuring processing remains reliable whether launching a new product line or navigating seasonal surges.

This commitment is paired with personalized support. Every merchant partners with a dedicated account manager who understands both the operational realities and regulatory nuances of their niche. For PaymentCloud, payment processing is not merely a back-end necessity—it is a strategic asset, blending technology, compliance, and human expertise to help online businesses thrive against the odds.

How Merchant Experiences Illuminate the Value of Trusted Ecommerce Payment Processing

When it comes to selecting the right payment processor, merchant testimonials often reveal the true impact of a well-designed payment system. In high-risk ecommerce, where uncertainty and rejection are common, stories of success serve as powerful validation for others navigating similar challenges. Here’s how one client describes their experience with PaymentCloud:

AMAZING EXPERIENCE! After trying out other merchant processors I’m honestly so content that we picked PaymentCloud. Give it a try you won’t regret it.

Experiences like these highlight just how transformative reliable ecommerce payment processing can be. Merchants not only survive but thrive when equipped with tools and support that adapt to their needs, mitigate risk, and simplify the complexities of online transactions. For many, partnering with the right payment processor marks the turning point from uncertainty to sustainable online growth.

Why Secure Ecommerce Payment Processing is Non-Negotiable for Modern Online Businesses

As digital commerce accelerates, the underlying systems that empower seamless transactions must rise to meet new challenges. Ecommerce payment processing is no longer a background operation—it’s a frontline defense against fraud, lost sales, and operational setbacks, particularly for high-risk merchants. The expertise and innovation demonstrated by PaymentCloud exemplify what’s possible when payment infrastructure is built on security, adaptability, and human support.

Businesses that prioritize robust and flexible ecommerce payment processing position themselves to avoid costly errors, deliver superior customer experiences, and sustain growth even in volatile industries. The capability to integrate with leading ecommerce tools, manage complex risk profiles, and deliver reliable results makes modern payment processing an absolute imperative. For companies aiming to earn customer trust and expand their online reach, the future demands that payment systems aren’t just efficient—they’re strategic, secure, and built for resilience.

Contact the Experts at PaymentCloud

If you’d like to learn more about how ecommerce payment processing could benefit your business, contact the team at PaymentCloud.

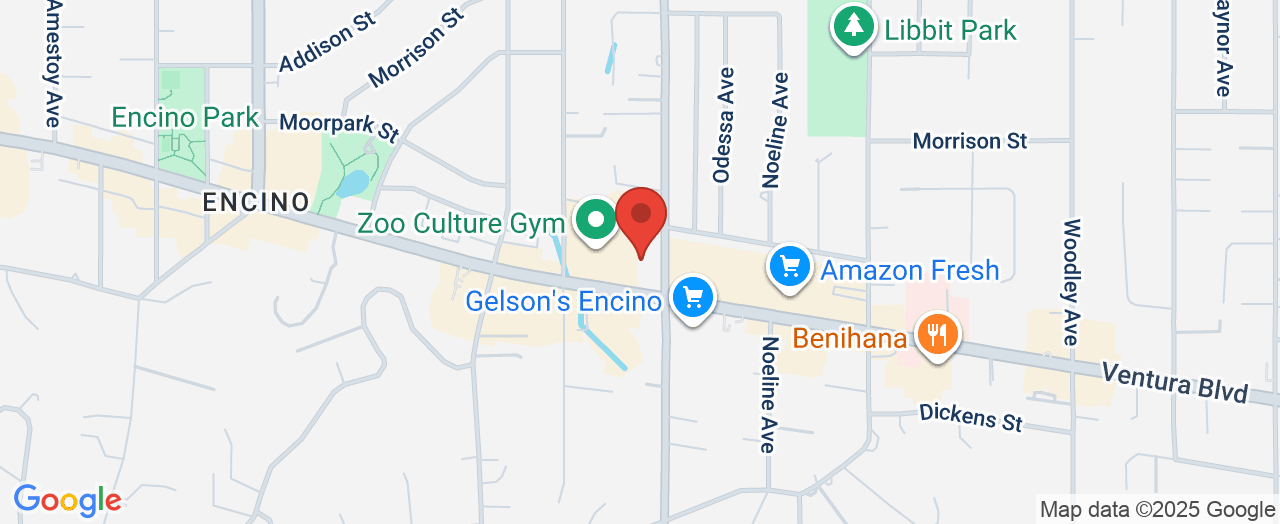

📍 Address: 16501 Ventura Blvd #300, Encino, CA 91436, USA

📞 Phone: +1 800-988-2215

🌐 Website: https://paymentcloudinc.com/

PaymentCloud Location and Hours of Operation

🕒 Hours of Operation:

📅 Monday: 5:00 AM – 6:00 PM

📅 Tuesday: 5:00 AM – 6:00 PM

📅 Wednesday: 5:00 AM – 6:00 PM

📅 Thursday: 5:00 AM – 6:00 PM

📅 Friday: 5:00 AM – 6:00 PM

📅 Saturday: 5:00 AM – 5:00 PM

📅 Sunday: 8:00 AM – 5:00 PM

Add Row

Add Row  Add

Add

Write A Comment