California’s Lumber Sector: Why Complex Risks Make Specialized Insurance Essential

Wildfires, regulatory shifts, and volatile markets have all become defining risks for California’s lumber sector in just the past decade. The region’s timber and lumber companies face a uniquely challenging environment. Not only do they navigate the natural hazards and liability exposures inherent to forestry and wood processing, but regulatory compliance, workforce safety, and the prospect of catastrophic property loss all demand tailored attention. The questions every business leader in this sector should ask: are generic policies protecting these uniquely Californian assets? And how can gaps in insurance coverage today threaten an entire operation’s financial survival tomorrow?

Lumber industry insurance in California is not a simple add-on or afterthought. Without it, the full force of regional perils—from employee injury on a sawmill floor to damage from a wildfire or theft of high-value equipment—can devastate balance sheets, disrupt supply chains, and expose owners to lawsuits or regulatory penalties. The stakes are higher in California, where both environmental concerns and operational liabilities loom over every business in the timber value stream. For decision-makers, understanding what specialized insurance includes—and how it can mean the difference between resilience and vulnerability—is not just important; it’s indispensable. In the following, we dig into what distinguishes comprehensive coverage for the lumber sector and why reading beyond the fine print could shape your company’s future.

Decoding Lumber Industry Insurance: Unpacking Complexities to Safeguard Your Operation

Lumber industry insurance in California isn’t just another line item; it’s a multifaceted shield specifically crafted for an industry in perpetual motion. Unlike general commercial policies, sector-specific insurance must address hazards that are both routine and extraordinary—property risks from fire and weather incidents, liability from machinery mishaps, and even the ripple effects of environmental regulation or product defect recalls. Policy language, exclusions, and coverage limits all take on heightened importance in a state where a single incident, such as a wildfire started at a lumber yard, could trigger millions of dollars in loss or third-party damages. Without mastering these details, operators risk finding themselves exposed when it matters most.

Additionally, coverage for trucks, timber stockpiles, and specialty processing equipment needs to adapt as the business grows, new regulations arrive, or climate patterns change. Many business owners underestimate how quickly an outmoded policy can fall behind today’s industry threats. Inadequate insurance jeopardizes not only property and operations but long-term contracts, community trust, and credit relationships. That’s why informed companies pursue insurance that keeps up with industry dynamics, delivers robust risk management, and ensures their investments—and their people—are protected against the unpredictable.

How Tailored Insurance Builds Real-World Resilience for California Lumber Operations

Expert guidance in lumber industry insurance is more than reassurance; it directly enables businesses to withstand adversity and secure their future. Agencies with a legacy in commercial insurance bring a nuanced understanding of the region, having developed solutions with each company’s unique exposures at the forefront. California’s lumber industry is dynamic—affected by environmental pressures, shifting economic demands, and evolving workplace safety requirements. A partner with experience in these domains will not only deliver comprehensive risk management services but also support policy customization as conditions shift.

An agency’s independent approach is particularly valuable, as it allows clients access to an array of competitive plans rather than a single-template solution. This means better protection for high-value equipment, in-depth liability coverage tailored to the realities of forestry work, and employee benefits that matter in talent retention. For many operators, this expert attentiveness doesn’t just prevent losses: it positions the business for continuity, growth, and community trust—even when disaster strikes or the regulatory climate changes. A retention rate of over 95% in such a complex field speaks volumes to the confidence clients place in specialist providers who consistently deliver measurable results.

Why a Local Mindset and Community Integration Matter in Lumber Industry Risk Management

Insurance agencies embedded in the regions where lumber companies operate offer a crucial strategic advantage. Their deep connections allow them to anticipate the distinct risk landscape for California’s forests, mills, and transport routes. Policies are not formed in abstraction but shaped with input from those who know firsthand the threats and opportunities that define the state’s timber sector. Local agencies maintain a stake in the economic and environmental wellness of their communities—this focus often translates to advocacy during claims, proactive risk prevention resources, and adaptive strategies when regional hazards escalate.

Such an approach honors both business priorities and community welfare. Instead of out-of-state or one-size-fits-all carriers, local firms intervene as trusted members of business decision-making teams. Their reputation for service, including promptness and respect shown by their personnel, creates a sustained partnership in not only protecting losses but also advancing the broader aspirations of California’s lumber-dependent towns and regions.

Adapting Insurance as Workplaces and Regulations Evolve: The Role of Employee Benefits

In California’s competitive employment market, lumber operations must go beyond minimum compliance—the right insurance extends to carefully crafted employee benefit programs. Solutions encompassing health, disability, executive incentives, and retirement packages are not perks but strategic investments in workforce wellbeing and loyalty. When insurance agencies structure these offerings as part of a broader risk mitigation philosophy, companies benefit from reduced claims, increased retention, and a heightened ability to attract skilled labor.

What distinguishes a leader in this space is a commitment to ongoing review and adaptation. As regulations governing workplace safety and employee rights grow more complex, regular assessments ensure benefit programs remain competitive and legally robust. Forward-looking providers help employers anticipate and incorporate changes, shielding them from compliance pitfalls while supporting a healthy, satisfied team—often the backbone of operational safety and long-term business success.

Building Trust through Industry Longevity and Independent Advocacy

Few elements are as critical in insurance as trust. Agencies that have operated for generations—since 1935 in some cases—bring a level of continuity and institutional memory that’s rare in a fast-changing industry. Such track records are built on working for clients, not insurance companies, and advocating for tailored coverage rather than quick fixes. This approach is reflected in persistent recognition and industry awards, a high rate of client retention, and a culture of earned respect across business relationships.

Industry advocates also cultivate a practice of giving back—channeling their expertise into both client education and community support. In the world of lumber industry insurance, this means not only handling crises as they emerge but proactively fortifying clients against what’s next. The alignment of professional service and civic engagement further cements long-term loyalty and places agencies as pillars of not just risk management, but regional prosperity.

A California Perspective on Precision: Specialty Coverage in Action

Philosophically, true expertise in lumber industry insurance is rooted in understanding every element of a business’s operation and risk portfolio. Rather than a cookie-cutter approach, reputable agencies emphasize a holistic review of client needs—property, liability, people, and long-term goals—before designing coverage strategies. This is especially salient in the high-stakes environment of California, where every season brings its own threats, and adaptability is crucial for survival.

This ethos is reflected in an agency’s commitment to lasting relationships, not transactional sales. They approach insurance as a dynamic partnership, earning their role as decision-making allies who anticipate change, re-evaluate exposure, and recommend coverage enhancements aligned with each business’s evolving journey. In this way, specialty insurance becomes more than a safety net—it’s foundational to operational stability, fiscal health, and community confidence.

What Clients Experience Firsthand: Confidence in Service and Support

The proof of an insurance agency’s professionalism and effectiveness is often best captured in the authentic words of those they’ve assisted. For many in California’s lumber industry—and indeed other commercial sectors—reliable service and informed guidance are more than abstract promises. They become tangible benefits that make navigating risk less daunting and business continuity more certain. Consider the following endorsement, which encapsulates this real-world value:

Excellent Service! Very nice staff, highly recommend!

Success in lumber industry insurance is evident not just in policy documents, but in the peace of mind, accessibility, and proactive support clients receive. When those who work with dedicated agencies describe their experience in such terms, it sets a clear benchmark: trustworthy advisors who elevate client experience and foster enduring partnerships are invaluable assets to any business seeking resilience.

Establishing the Gold Standard for Lumber Industry Insurance in California

Comprehensive insurance for California’s lumber sector is not simply a regulatory checkbox or operational safety net. It’s the strategic foundation upon which businesses build their resilience against both predictable and unprecedented risks—natural disasters, workplace incidents, evolving compliance, and more. Agencies that combine independent advocacy, local expertise, and tailored solutions have reshaped industry norms, setting benchmarks for service, reliability, and client trust that others strive to match. As the complexities of the state’s timber landscape continue to evolve, only those armed with specialized lumber industry insurance in California will be truly prepared to secure long-term prosperity and community contribution.

With a history of industry leadership and a commitment to personalized service, George Petersen Insurance Agency exemplifies the blend of experience, integrity, and foresight essential for navigating California’s distinct risk climate. For business owners, partners like these represent not just a policy but a strategic ally—one invested in their growth, protection, and continued success as the industry moves forward.

Contact the Experts at George Petersen Insurance Agency

If you’d like to learn more about how lumber industry insurance in California could benefit your stability and peace of mind, contact the team at George Petersen Insurance Agency.

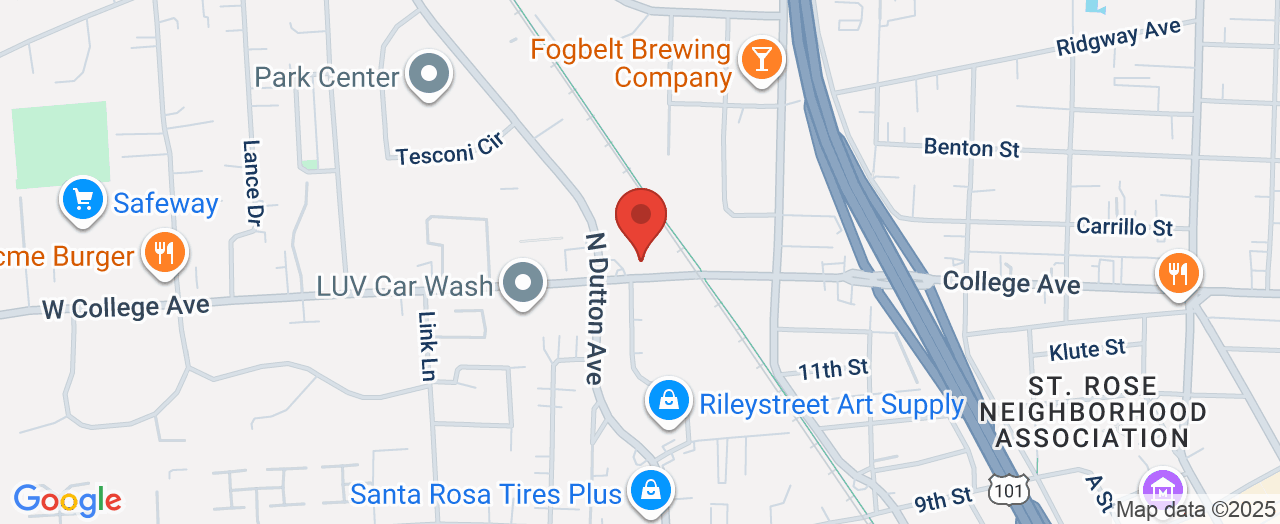

📍 Address: 175 W College Ave, Santa Rosa, CA 95401, USA

📞 Phone: +1 707-525-4150

🌐 Website: http://www.gpins.com/

George Petersen Insurance Agency Location and Availability

🕒 Hours of Operation:

📅 Monday: 8:30 AM – 5:00 PM

📅 Tuesday: 8:30 AM – 5:00 PM

📅 Wednesday: 8:30 AM – 5:00 PM

📅 Thursday: 8:30 AM – 5:00 PM

📅 Friday: 8:30 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment